Taxing Times In Halifax

The Cost of Growth: How Halifax's Welcoming Spirit Taxes Its Property Owners

For cities, towns, and amalgamated areas around the country it’s budget time and things aren’t looking good for the coming fiscal year.

FIRST PRINCIPLES: We all want peace, prosperity, and progress at the lowest possible cost.

Here in Halifax, the annual raising of the red flag has already gone up. And the local media, flummoxed as they are by any numbers in the news, try to make some truly twisted talking points into headlines.

Clearly, outrage and fear drive readership, so somehow the now annual threat of an unreasonable tax bill increase is a boon for the online newspaper if nothing else.

Let’s just talk about this typical headline and then get into the real story that we all should, but can’t, talk about.

To start, a 9.7% property tax increase IS the inflation. That is, if it were to happen. Council does this annual huckster shell game and plays it for all it’s worth. An $11 million drop in deed transfer tax is notably less than 1% of the budget, hardly headline material, but a $100 million plus shortfall is concerning for everyone. How do we finance it? The talking point messaging is clear - it’s the homeowner’s fault and they’re going to have to fix it. Ultimately, this is true. The homeowner citizens get the government they are willing to put up with, and in the long run, there is only one source of revenue for the city… the homeowner taxpayer.

It’s the fundamental truth of municipal finances. Most of the burden is carried by homeowners paying property taxes and other fees.

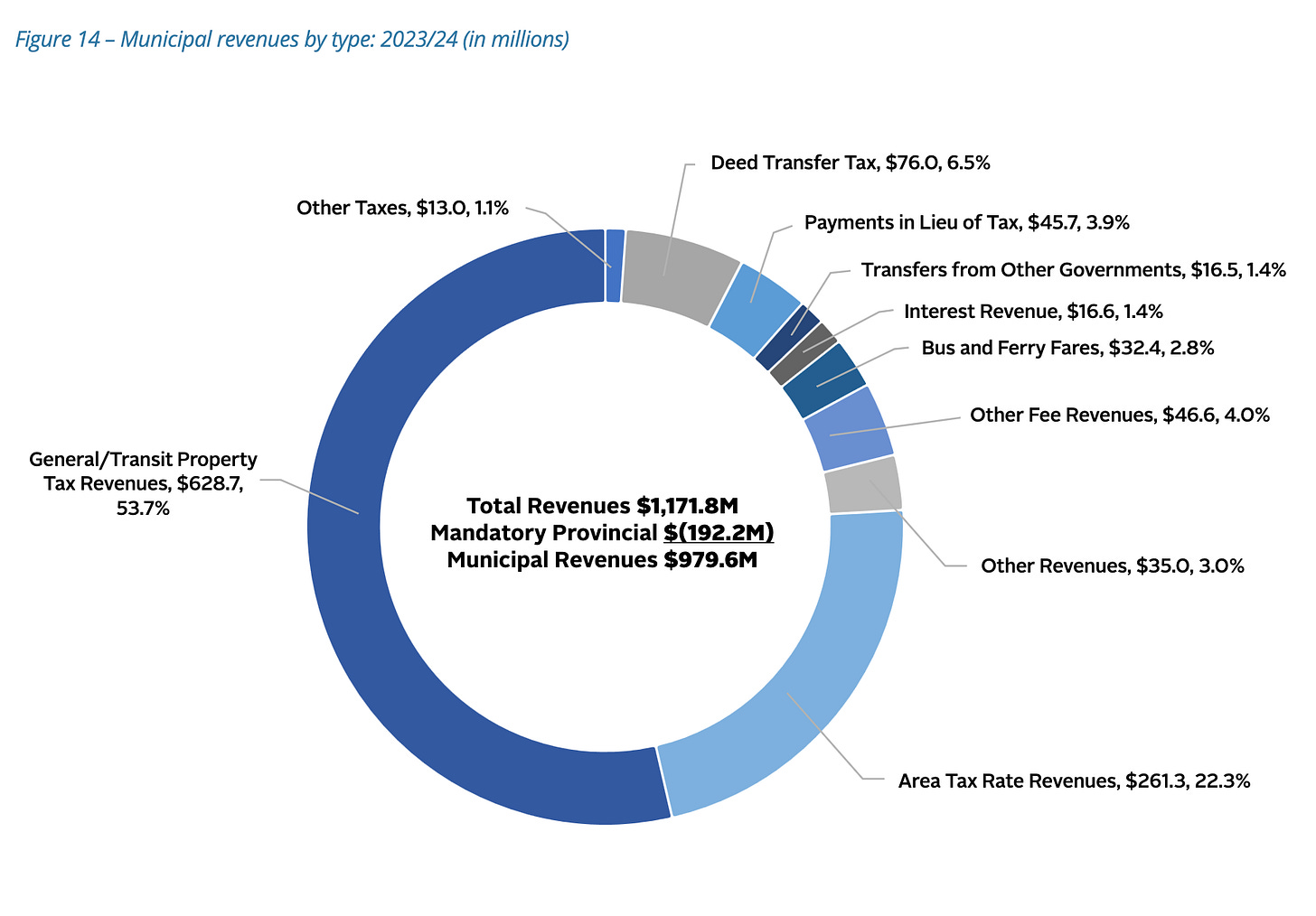

Take a look at Halifax revenue for the last year:

Property tax - 53.7%

Area Tax (an additional property tax) 22.3%

Deed Transfer Tax (on properties) 6.5%

Payments in lieu of Tax 3.9%

Add in the homeowners’ share of the other items and in total homeowners supply over 90% of the municipal budget in Halifax. That’s not unique to Halifax. That’s how it works. Municipal governments exist by taxing homeowners.

Ah, Halifax! A city where the sea meets the sky, and the charm of the Maritimes is as renowned. But beneath the happy veneer lies a fiscal fightclub. The heart of the matter? Property taxes.

Here’s how the bureaucrats put it… with great care… from last week’s news…

In their report, staff say it’s due to rising inflation, “lower non-tax revenues” and continued population growth.

HRM’s population is expected to tip over the 500,000 mark during the next fiscal year, the eighth year in a row where growth has outpaced housing growth.

“The gap represents an increasing demand on services provided by the municipality whilst the base which tax is levied on is not growing at the same pace; the growth is not paying for growth or inflation,” staff wrote.

Now, I don’t know who the unnamed staff bureaucrat was who wrote that last line, but it is a quote for the ages.

Growth is not paying for growth. (anonymous)

The current system can not work and the homeowner will ultimately have to pay for it all. The Mayor, quoted across media last week, had a simple sales pitch, Don’t Freak Out.

How Did We Get Here?

In the beginning, property taxes in Halifax, much like everywhere else, were straightforward. Based on the assessed value of properties, these taxes have been the city's bread and butter, funding everything from the mundane to the magnificent.

The plot thickens in the 1990s. Halifax, along with Dartmouth, Bedford, and Halifax County, got Amalgamated, merging into one Halifax Regional Municipality (HRM) in 1996. This amalgamation, akin to a dramatic plot twist in a soap opera, brought diverse tax rates and assessment methods under one roof. Everyone wanted a piece of that now gigantic pie.

Fast forward to the early 2000s, and the HRM started reassessing properties at market value. This shift was as significant as switching from black and white to Technicolor. Properties in high-demand areas, especially those with waterfront views that could make a poet weep, saw their assessments skyrocket.

Cue the public outcry. Residents, feeling the pinch, voiced their concerns. The HRM, in response, introduced the CAP program (Capped Assessment Program) in 2005. This program, a band-aid solution of sorts, aimed to limit how much a property's assessed value could increase in a given year. It was like telling the sun to rise a tad slower.

However, this solution was a double-edged sword. While it offered relief to some, it created disparities. New homeowners often found themselves paying more taxes than their long-time neighbors for similar properties. It's like buying tickets for a concert only to find out the person next to you paid half the price for the same view.

Fast forward to the present day, and the property tax review process in Halifax continues to evolve. The city strives to balance fairness with fiscal responsibility but it seems like the tax department won’t be happy until no one is happy.

It’s a shell game of change, challenge, and complexity, run by carnival barker councilors clinging to the best jobs they’ll ever have and backroom bureaucrats - unaccountable, unnamed, and unfirable.

The government - at all levels - continues to present you with a riddle that it tells you that you just aren’t smart enough to understand: we need more immigration to fix the economic crisis caused by immigration.

I’d like you to open yourself up to the idea that you, and everyone else if freed from the ideology of the age, are perfectly smart enough to solve this riddle - by rejecting it as ridiculous.

Today Halifax, like most small cities, the government's coffers are filled primarily through property taxes. It's a straightforward equation: you own property, you pay taxes, and these taxes fund everything from regular road repairs to big-box mega-projects. The Halifax Regional Municipality, according to its 2021-22 Budget, leans heavily on property taxes, which account for a lion's share of its revenue.

But here's the problem: Halifax is growing, and it's growing fast. A report by the Halifax Partnership highlights the city's rapid population growth, outpacing many other Canadian cities. More people means more demand for housing, more strain on infrastructure, and more need for government services. Yet, the property tax revenue isn't keeping pace. Why? A housing shortage.

Everyone Needs a Home

The housing market in Halifax is tighter than ever. The CMHC reports a vacancy rate that's been hovering around 1%. This scarcity of housing options leads to a peculiar problem: property values skyrocket, but the number of properties to tax doesn't grow proportionally. It's like trying to fill a bathtub with a thimble.

Balance sheets gotta balance. It’s right in the name. If housing growth, the main source of new income for the city, is less than population growth, the main source of new costs, then the money has to come from somewhere. And the list of possibilities is short:

1/ Increased property tax… paid by homeowners

2/ Debt… paid by homeowners later, with interest

3/ Reduction in spending and services… at the expense of the homeowners

This mismatch creates a cascade of issues. First, there's the affordability crisis. As property values soar, so do taxes, making Halifax less affordable for the average family. This, in turn, can stifle the diversity and vibrancy that make Halifax the gem it is. Homelessness soars. Larger portions of incomes go toward just having a place to stay.

Then, there's the strain on city services. More people means more demand for everything from public transit to garbage collection. But without a corresponding increase in revenue, the city is trying to stretch a dollar into a ten. It's a fiscal gymnastics routine that would leave even the most seasoned accountant dizzy.

Then there’s the government employee. The best-paid, most secure, jobs in the province. To say they have influence at city hall would be an understatement. They are city hall. And there’s one thing to know from history about bureaucracies. They grow. The new thing to know about Nova Scotia’s bureaucracies is… they are unproductive and inefficient. In the country, in the world, and in history, by every measure, the cost of government relative to what we produce is astonishingly low. By the numbers, it reads more like a (work from home) adult daycare than the engine of the economy…

So, what's the solution? It's a Gordian knot that won't be easily untangled. Some advocate for diversifying revenue sources, perhaps looking to models used in other cities. Others suggest incentivizing development to increase the housing stock, thus broadening the tax base. You won’t read much about it in the news but new governments in other countries and the majority of those polled in many areas suggest something radically politically incorrect and often called racist… slow immigration to match infrastructure and social capacity for population growth.

In the end, Halifax's situation is a microcosm of a larger narrative playing out in Canada as it races forward with a political ideology of immigration growth at all costs. It's a tale of growth, challenge, and the perpetual quest for fiscal balance. As Halifax navigates this mess, it serves as a case study in urban economics and a reminder that even the most charming of cities must grapple with the mundane realities of balancing budgets and balance sheets.